Image by Mickey O’neil from Unsplash.

What is the theoretical basis for identifying benefits?

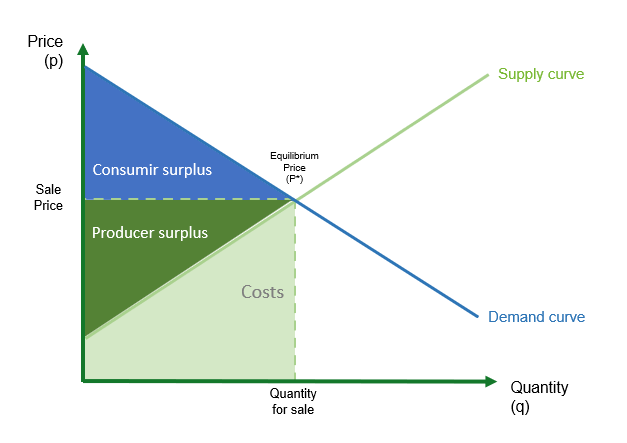

To develop a cost-benefit analysis, we must first understand the concepts of producer surplus and consumer surplus.

- Producer Surplus: This is the profit producers earn by selling at a price higher than their marginal cost of production. In the context of mining and hydrocarbons, this includes profits after covering all operating, capital, and environmental costs.

- Consumer Surplus: This is the difference between what consumers are willing to pay and what they actually pay. Although the primary focus in the exploitation of non-renewable resources is on producer surplus, consumer surplus can be relevant when final consumers benefit from a price reduction due to an increase in supply.

Figure 1 shows how the concepts of producer and consumer surplus, as well as production costs, are calculated. It also demonstrates that project revenues can be calculated by multiplying price by quantity, which affects producer surplus and costs.

Figure 1: Producer Surplus, Consumer Surplus and Costs

When a project is developed for the first time, producer surplus can be understood as shown in Figure 1.

How are benefits identified when our operation makes modifications to increase production or optimize costs?

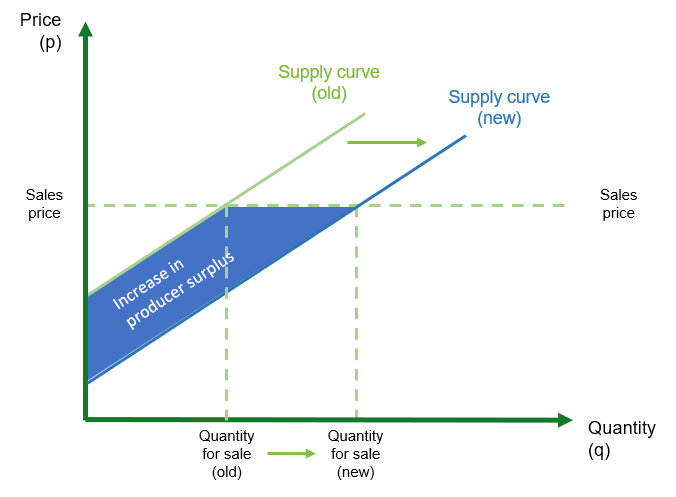

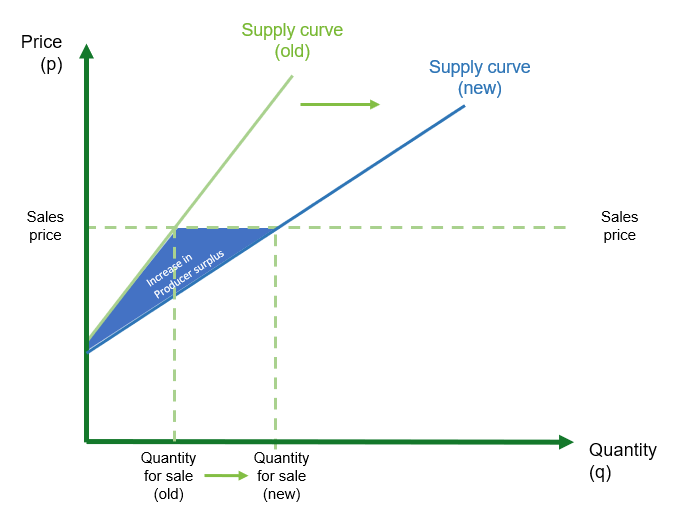

In the case of increased production, likely due to the exploitation of new resource reserves, this results in a rightward shift of the supply curve. For the analysis, we assume that the prices of the produced goods do not vary because they are determined in global markets, as is the case with commodities.

Figure 2 shows how the supply curve shifts to the right and highlights the increase in producer surplus.

Figure 2: Increase in producer surplus due to increase in production

Figure 3 shows the case when the operation optimizes its costs, reflected in the flattening of the supply curve, which is consequently associated with an increase in producer surplus.

Figure 3: Increase in producer surplus due to optimized costs

In Peru, these two cases of modifications are the most common reasons for preparing an Environmental Impact Study Modification for an operation, also referred to as MEIA. As with its predecessor, the Environmental Impact Study (EIA), a Cost-Benefit Analysis is also required.

How can benefits in a project that exploits non-renewable resources be differentiated?

Based on the categorization referred to by the MEF (2022) guide, we can identify the following benefits:

- Direct Benefits

Direct benefits are directly associated with producer surplus. Specifically, they relate to the rents generated by the operation, including the net profits of the operator and the income taxes collected.

However, it is necessary to conduct an analysis of the distribution of these benefits.

This point on the distribution of benefits will be developed in another post. - Indirect Benefits

- Increase in local workers’ income: Increase in producer surplus for local workers due to their employment in the project, where these incomes are higher than their opportunity cost (i.e., what they would earn in other available jobs).

- Benefits for local suppliers: Increase in producer surplus for local suppliers due to the increase in demand for goods and services necessary for the operation of the project. This refers to the additional profits local suppliers earn by selling their products and services to the project after covering their production costs.

- Benefits for Landowners: Compensation to landowners for the use of their land, where these payments exceed the opportunity cost of the land’s previous use (i.e., the income they would have generated if the land had not been used for the project).

- Positive Externalities

- Development of Infrastructure and public services:

Increase in producer surplus related to the improvement in local infrastructure that reduces operational costs for local companies and costs to access public services. - Technology and knowledge transfer:

Increase in producer surplus related to the reduction of operational costs and increased efficiency for local companies and public management.

The examples of listed benefits can be further analyzed through the analysis presented in Figure 2 and Figurue 3, although with some differences specific to the context of a good or service.

What is the treatment of secondary benefits in a Cost-Benefit Analysis?

In a Cost-Benefit Analysis (CBA), the treatment of secondary benefits, defined as multiplier effects in the economy, should not be included directly. The CBA focuses on first-round impacts, that is, those benefits and costs that are the direct and immediate consequence of the project, as presented in the previous point. This ensures that the analysis remains centered on the immediate and verifiable effects of the project.

The guidelines from the New South Wales Government (2015) emphasize that these multiplier effects can be relevant for local communities and may be included in a Local Effects Analysis.